0512-67998889(Suzhou)

18051093220(Shenzhen)

The following article is from Arterial New Medicine, by Chen Xuanhe

As a cutting-edge enterprise in macrophage drugs, RocRock Biological participated in the organoids and organ chip industry white paper of new arterial medicine tissues from the perspective

of cell drugs and clinical needs, which was released on May 7.

The development history of human medicine, in order of time, can be basically divided into chemical drugs, protein drugs, cell drugs and organ drugs that have not yet arrived. Among them,

organoids and organ chips are precisely in the intermediate transition stage of cell drugs and organ drugs, and will play a very important transition and counseling role in the next five to ten

years. With the repositioning of the rules of the international drug evaluation game, Europe and the United States have significantly accelerated in deanimalization, accompanied by several

big actions of the FDA, organoids and organ chips have attracted a lot of industry attention in the past two years. Due to the great correlation between such technologies and traditional

biological models, similar discussions have been raging for a while.

History of human medicine

In the early stage of development of any industry and industry, disputes precede. Since most people outside the industry do not know much about the industry, "this kind of new technology

will change the current industry development order, and soon will be able to show a more humane world picture - 'no longer rely on animals, you can carry out all the necessary pre-clinical

tests to test the safety and effectiveness of various substances'" the warm vision has been mapped in the minds of most people outside the industry.

The wide application prospect and huge development potential make the track hot in a short time. Behind the endless imagination, accompanied by a surge of adrenaline in the body. The

rapid flow of funds expresses the market's enthusiasm and expectations, even when most people have not yet clarified the difference between the concept of organoids and organ chips, the

track has completed the issuance and placement of first-half tickets.

But the world of the Republic has never been easy to reach, and the path forward tends to spiral, with many difficulties and challenges.

In order to show the most real development of the organoids and organ-on-a-chip industry at present, and to explore the truth behind many different statements, as a cutting-edge

enterprise of macrophage drugs, Kenshi Biology participated in the writing of the white paper of the organoids and organ-on-a-chip industry of the new pharmaceutical organization of the

artery from the perspective of cellular drugs and clinical needs. We conducted in-depth research on nearly 50 representative enterprises of the global organoid and organ chip industry,

carefully sorted out the background origin and development context of the global organoid and organ chip industry, and conducted in-depth dialogue with the core executives of nearly 30

domestic enterprises and a number of industry investors. At the same time, the microphone was handed to experts who have relevant industry background but do not currently have relevant

interest relations, and strive to show an objective and neutral picture of the development of the industry.

▼ ▼ ▼

Core idea

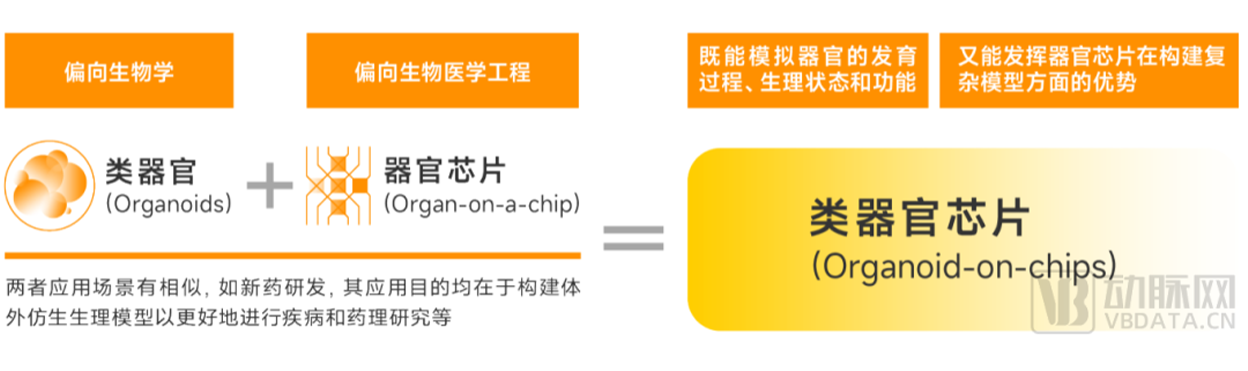

1, organoids and organ chips belong to different subdivisions, but the application scenarios and application purposes are similar, so they are often mentioned in parallel or even confused.

Organ-on-a-chip refers to using organoids as the cell source for organ-on-a-chip to combine the advantages of both.

2. There is a large population base of cancer patients in China, and the development trend is constantly rising. The awareness of early screening of Chinese patients is weak, and the diagnosis

is often in the middle and late stages. The complexity of new drug development model requirements and treatment programs has promoted the rapid development of the organoid and organ

chip industry, and the international trend of deanimalization has further helped.

3, organoids and organ chip industry is still in the early stage of development, the middle and downstream demand has not yet been scaled up. With the further development of the industry

in the future and the landing of relevant policies and standards, the industry's demand for upstream volume, the first in-depth layout of upstream enterprises have a first-mover advantage.

4. Foreign policies and financial support are more in place, research is carried out earlier, and the development progress of the overall industry of organoids and organ chips is faster than that

of China. In particular, some foreign organoid enterprises have solved the compliance and ethical problems of organoid culture and use; The domestic organoid industry is developing rapidly,

but its ability in organoid culture quality control and sample compliance needs to be further improved. Foreign organ chip enterprises are in the leading position and occupy most of the

market share, the domestic organ chip research start time is similar to the United States, but the technology accumulation is slow, the industrialization process is lagging behind.

5, the development of domestic industry, organoids more prosperous, the number of foreign industrial organ chip enterprises accounted for a larger proportion, the main reason is that

different technology accumulation basis and because of different national conditions caused by the development of market demand differences.

6. There are two main business models in the global organoid and organ chip industry: product direct selling and service provision. The three future development paths of the industry:

precision instrument and equipment enterprises, CRO and Biotech.

7, the market for organoids for drug susceptibility testing is very hot, but there are also some development limitations that need to be looked at objectively. For example, the high

heterogeneity of tumors leads to the difficulty of large-scale application of products, and the proportion of tumor patients who have real demand and have the opportunity to benefit from

organoid precision medicine in the stock and incremental population is relatively limited.

8, automation, high-throughput, in vitro real-time detection, refinement, systematization and the combination of AI, gene editing and other technologies is the inevitable trend of the

development of the industry.

"Suddenly" hot organoids and organ chips

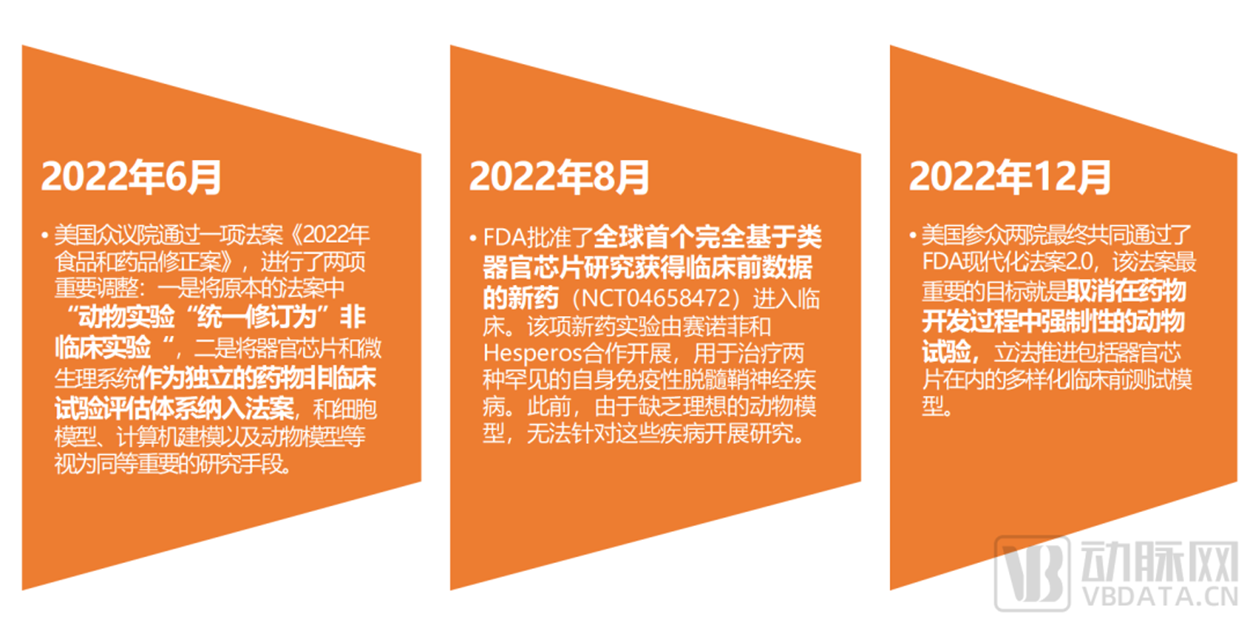

With several big actions by the FDA, the enthusiasm of the organoids and organ chips industry has reached a historical peak in the past two years.

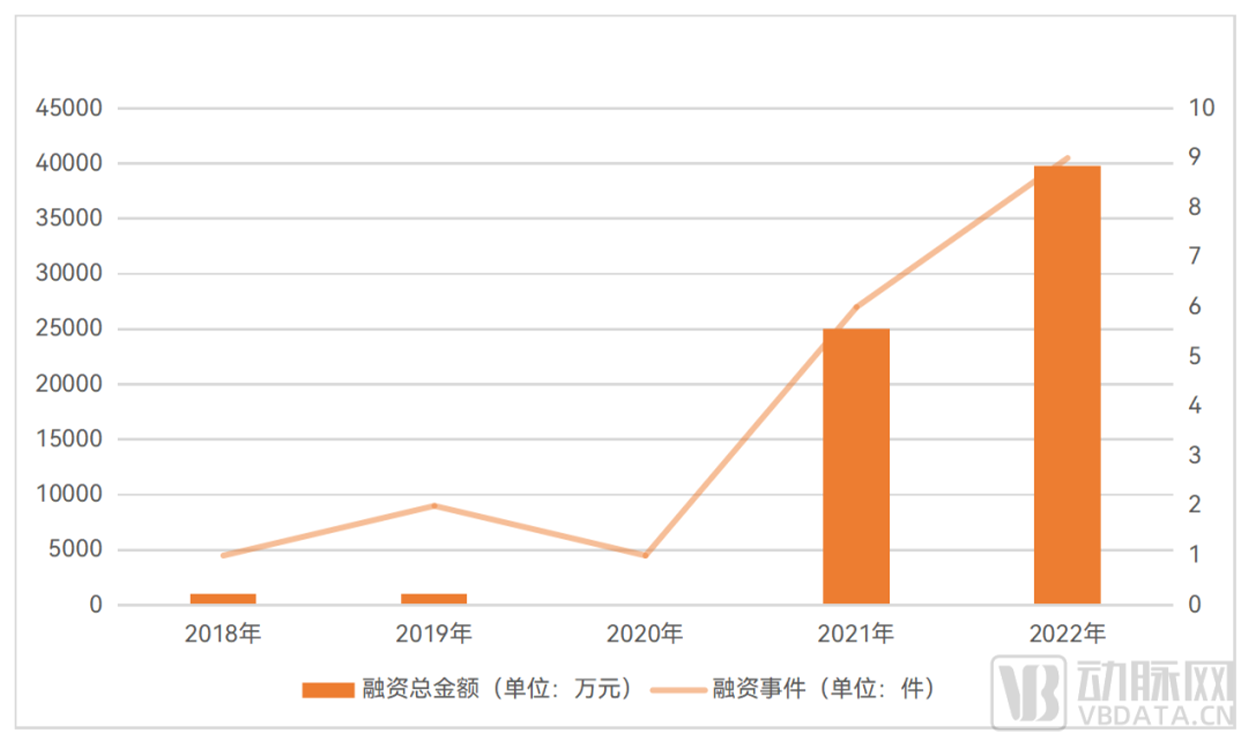

In 2021 and 2022, the investment and financing of the organoid and organ chip industry will grow rapidly, and both financing events and the total amount of financing will hit new highs - in

2021, there were 6 financing events in China's organoid and organ chip industry, with a total financing amount of 250 million yuan; In 2022, there were 9 financing events in China's organoid

and organ chip industry, with a total financing amount of nearly 400 million yuan.

Long time line, in the past 5 years, China's organoids and organ chip industry investment and financing has been heating up.

▼ The financing situation in the field of organoids and organ chips in China in the past 5 years

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

In order to facilitate readers to understand the current situation of enterprises that are moving relatively quickly in the market, the Eggshell Research Institute has sorted out the

latest financing situation of domestic organoids and organ chip industry enterprises as follows.

▼ The latest financing situation in the field of organoids and organ chips in China

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

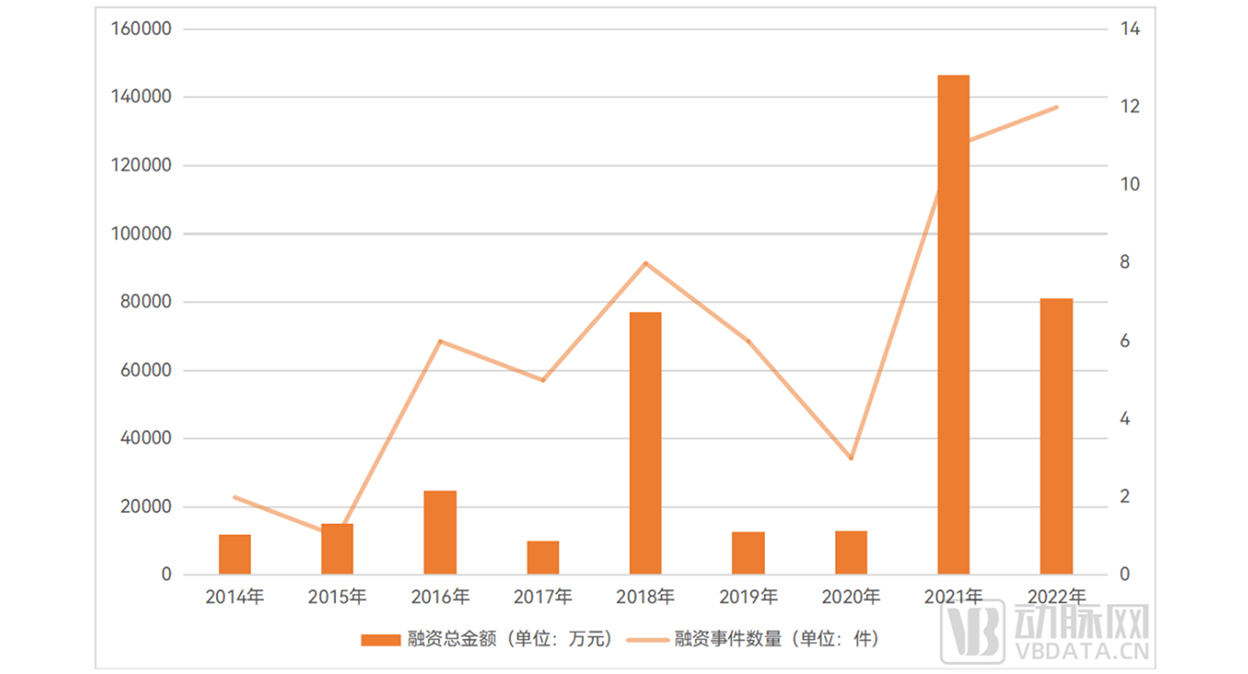

Expand the perspective, and then from the global situation, the financing situation in the field of organoids and organ chips is relatively volatile, but it also continues to rise.

Among them, in 2018 and 2021, the global organoids and organ chips field reached a new high in financing events and total financing amount, and a total of 8 financing events occurred in

2018, and the total financing amount reached 770 million yuan. In 2021, a total of 11 financing events occurred, with the total financing amount reaching 1.46 billion yuan.

2014-2022 Global organoids and organ chip industry financing overview

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

As the industry is in the early stage of development, the overall financing performance of the global market is greatly affected by the financing of individual star enterprises. For example, the

formation of every "new peak" of investment and financing in the field of global organoids and organ chips so far has been basically boosted by Emulate's company - in 2016, Emulate

completed a B round of $28 million in financing; In 2018, it completed a Series C financing of $36 million. In 2021, $82 million in Series E funding was completed. Another star startup, Xilis,

founded in 2019, has also become an important "joint force" to promote the formation of a new peak in the investment and financing market, such as the formation of the highest peak in

the investment and financing history of the global organoid and organ chip industry in 2021, of which nearly half are the "credit" of Xilis. From the point of view of the number and amount

of investment and financing, the organoid and organ chip industry is still in the early stage of development, and the competition has just started. Enterprises with core technology advantages

and complete production chains, and the earliest layout of the industry will undoubtedly have a first-mover advantage. Governments: strongly support and promote the development of the

industry, the United States attaches particular importance to the extensive application prospects and development potential of organ chips based on organoids and organ chips, and

governments of various countries strongly support and promote the development of the industry. Among them, the United States government attaches particular importance to the

development of the field of organ chips, providing a large number of research funds and practical support.

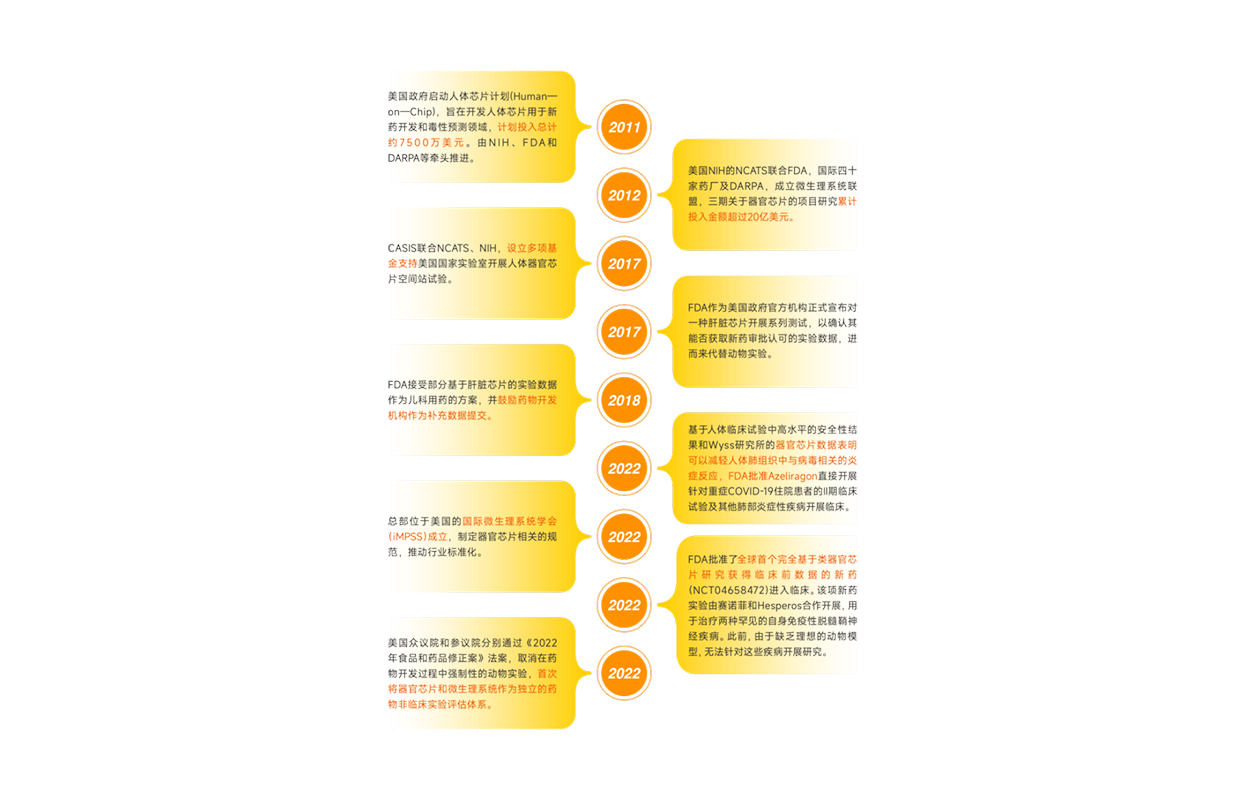

America's important support for the organ-chip industry

▲ Data sources: Arterial Orange Database, Organ-on-a-chip Network, Eggshell Institute Mapping

Since the announcement of the Human-on-Chip program in 2011, the relevant government agencies in the United States have not only invested a lot of research funds in the field of organ

chips, It has also encouraged and supported the formation of industry consortia such as iMPSS and the IQ Innovation and Quality Consortium, Establish a number of organ chip test centers

to promote the establishment of relevant industry standards and actively hold conferences and forums to strengthen exchanges between the industry and other ways to promote the

industrialization of the organ chip industry.

▼IQ Alliance profile and key members

As an affiliate of the IQ Alliance, IQ MPS is dedicated to advancing the development and standardized application of microphysiological systems in the research and pharmaceutical fields, and

provides a platform for cross-pharmaceutical collaboration and data sharing within the Alliance.

▲ Data sources: companies and IQ Alliance official website, Eggshell Research Institute mapping

The EU has also increased its support for research related to human organ chips in recent years, both in terms of specific policy landing and financial support. For example, the introduction of

European policies such as the ban on the use of animals for cosmetics testing has greatly promoted the industry's attention to organoids and organ chips as possible alternative technologies

to animals.

In terms of financial support, the EU's largest investment in global science and technology development program - the EU Seventh Framework Programme (FP7, the seventh framework

Programme launched on January 1, 2007, with a total budget of 50.521 billion euros) includes the organ chip project. The EU-Tox risk project, which started in 2016, also includes parts that

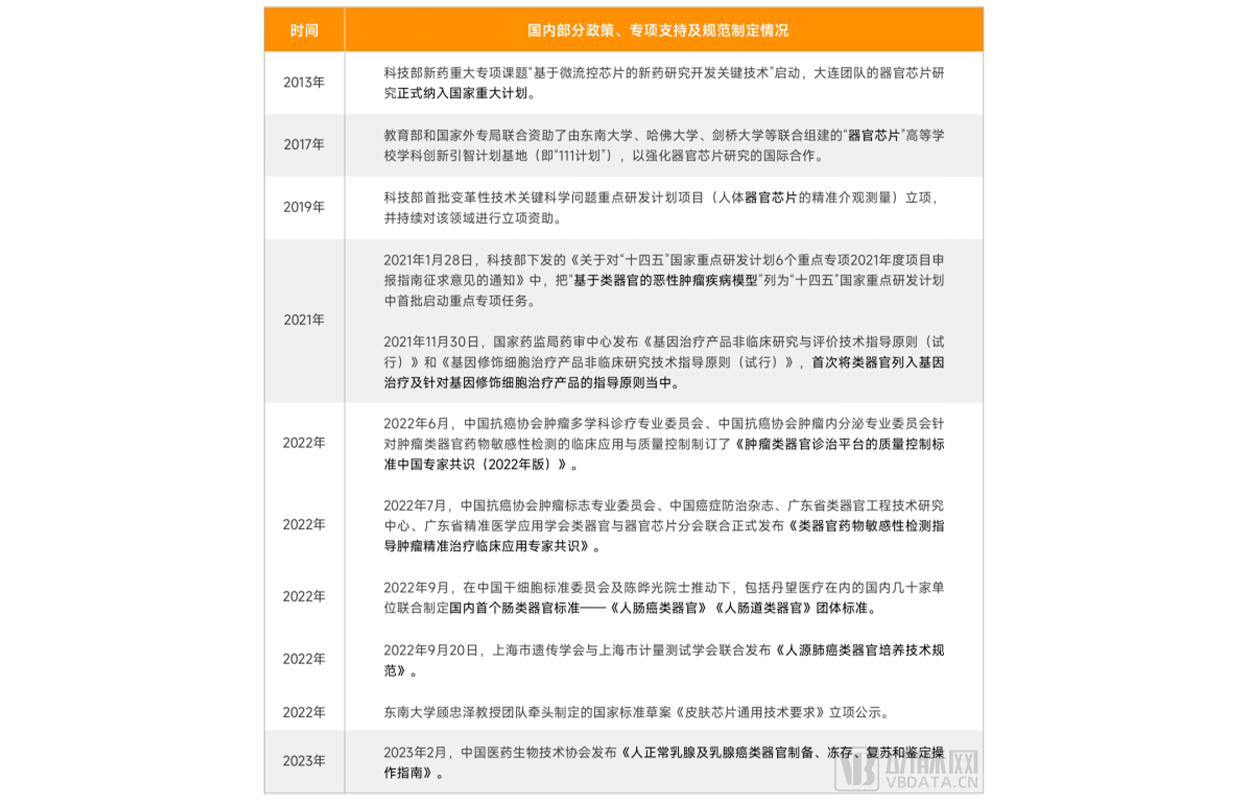

support organ chips. At present, our government pays more attention to the development of organoids. In the past two years, with the increasing attention of the government and the

increasing attention of capital, the draft team standards and national standards such as Human Intestinal Cancer Organoids, Human Intestinal Organoids, Technical Specifications for the

culture of Human Lung Cancer organoids, General Technical Requirements for skin chips, and Operational Guidelines for the preparation, freezing, resuscitation and identification of Human

normal breast and breast cancer organoids have been successively launched. Greatly accelerated the development process of the industry.

Some of China's policies, special support and standard specification formulation in the organoid and organ chip industry

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

In addition, the active support for the laboratory self-built detection method (LDT) pilot in recent years has also greatly promoted the enthusiasm of organoids and organ chip enterprises to

apply their products to clinical development, so that enterprises can obtain a part of the cash flow income in the process of early registration of products to support the better survival and

development of enterprises. At present, some public medical institutions in Shanghai, Guangzhou and other places have been listed as pilot comprehensive units.

Behind the hot development: the dilemma of new drug research and development, the arrival of the era of precision medicine and the trend of the international deanimalization industry

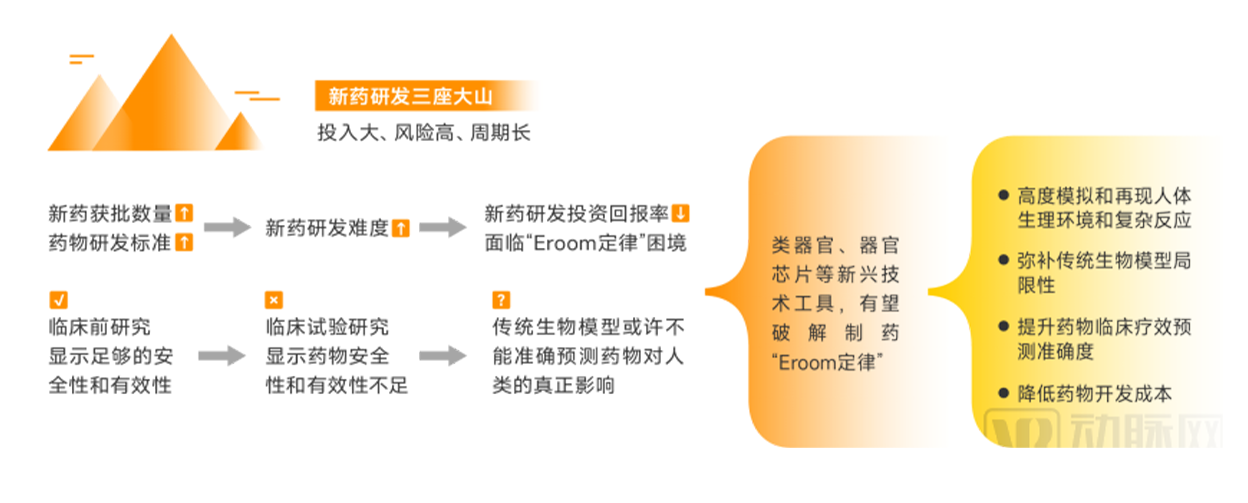

Any commercial technology is born with demand, and the same is true of organoids and organ chips. Solving the current difficulties faced by new drug research and development is an

important driving force to promote the development of organoids and organ chip industry.

New drug research and development difficulties promote the development of organoids and organ chip industry

▲ Data source: Research interviews, Eggshell Research Institute mapping

As more new drugs are approved for market, drug research and development standards are being continuously improved, resulting in higher and higher difficulty of new drug research and

development, higher and higher cost of new drug research and development, lower and lower return on investment, exacerbating the difficulty of new drug research and development. The

pharmaceutical community is eager to find new methods, paradigms, and tools to improve the success rate of new drug discovery.

In vitro bionic models such as organoids and organ chips, which can highly simulate and reproduce the human physiological environment and complex reactions, have become a new hope

to break the dilemma of the pharmaceutical industry.

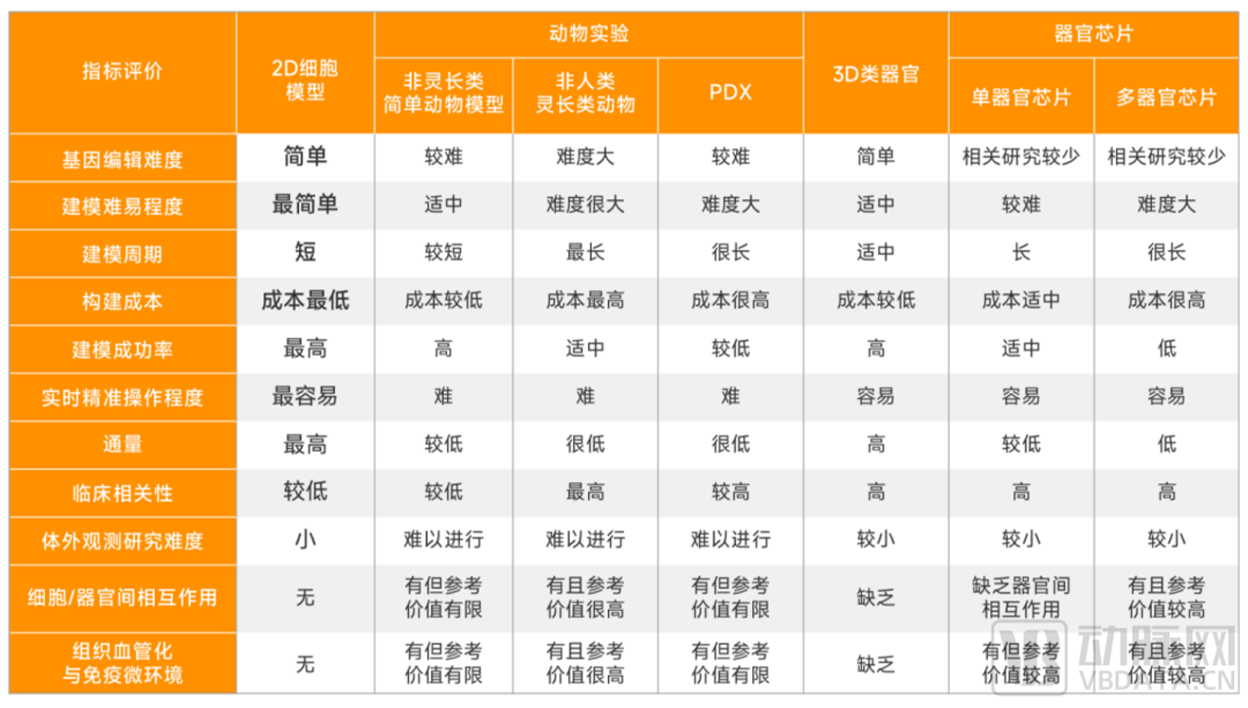

Advantages and disadvantages of 2D cells, mouse models, non-human primates, organoids, and organ-on-a-chip applications

▲ Data source: Research interviews, Eggshell Research Institute mapping

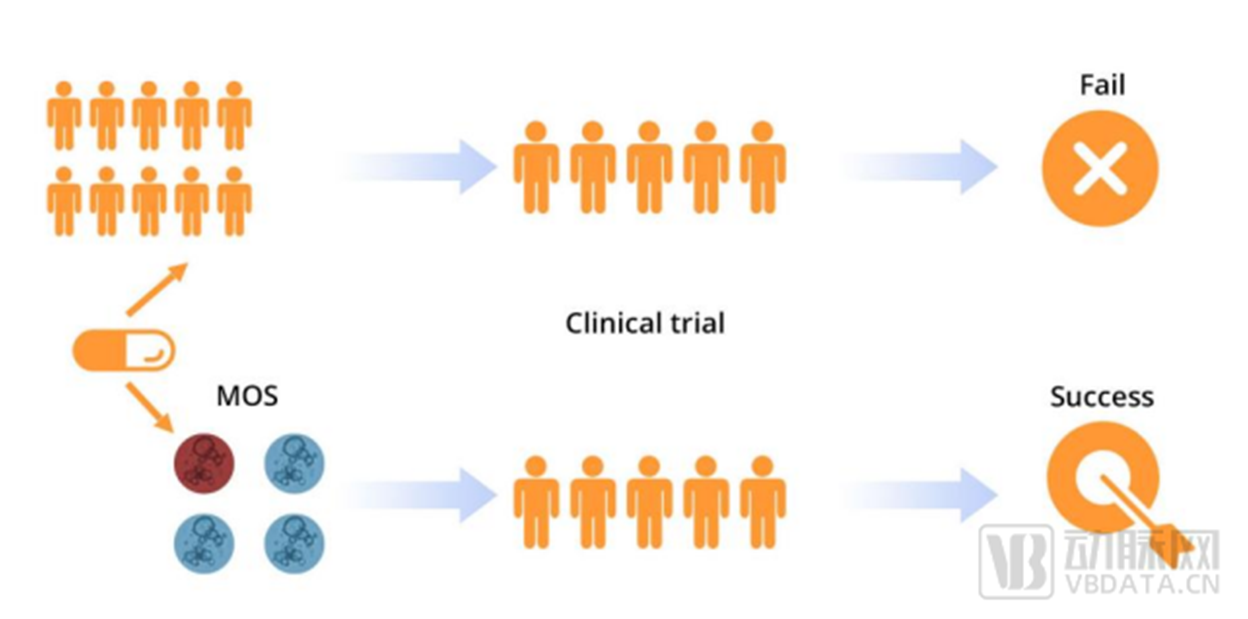

Through the use of in vitro bionic models such as organoids and organ chips, the prediction accuracy of drug clinical efficacy can be effectively improved and the cost of drug development

can be reduced.

Comparison of advantages and disadvantages of traditional biological models, organoids, and organ chip applications

▲ Data source: Research interviews, Eggshell Research Institute mapping

At the same time, due to the continuous progress of technology, the arrival of the era of precision medicine and the increasingly complex research and development of new drugs and other

reasons, the market demand for human high bionic models such as organoids and organ chips has further increased, and the industry has ushered in a period of vigorous development.

Precision medicine has been the focus of public attention in recent years. In terms of cancer precision therapy, the emergence of tumor organoids has created new opportunities for cancer

precision medicine.

The use of tumor organoids for drug sensitivity detection can accurately predict the response of patients to anti-cancer drugs, guide patients to avoid using toxic side effects and ineffective

drugs, select effective drug regimens to kill cancer cells, and reduce the risk of drug resistance and the probability of tumor recurrence. China has a large population of cancer patients, and the

development trend is constantly rising, so that tumor organoids have great application prospects in the field of drug sensitivity detection.

On the other hand, the complexity of the requirements for new drug research and development models and the complexity of treatment schemes have also promoted the rapid development

of the organoid and organ chip industry.

The traditional 2D cell model cannot simulate the communication between cells in different organs and the complex interaction of metabolites, hormones and immune system at the

microenvironment level. The traditional animal model also has some shortcomings, such as species differences, poor ability to predict the actual human reaction, ethical issues and limitations

of imaging observation. When it comes to diseases that are very human specific, such as immunity, metabolism, infection, CNS, rare diseases, etc., traditional schemes such as traditional 2D

cell models and model animals are difficult to model effectively.

In addition to the increasingly complex requirements of new drug development models, the complexity of treatment options further leads to the need for technologies such as organoids and

organ-on-a-chip.

Ten years ago, the pipeline of most pharmaceutical companies was dominated by small molecules, and now they have laid out innovative treatment solutions represented by small molecules

to large molecules, from chemical drugs to monoclonal antibodies, double antibodies, ADCs, proTACs, peptides, small nucleic acid drugs, gene therapy, and cell therapy. Since the mechanism

of action of most innovative therapeutic solutions is mostly in the microenvironment (that is, between cells), solving the problem of multi-cell co-culture is an inevitable requirement.

Finally, the international deanimalization trend further promotes the rapid development of the industry.

With the strengthening of animal protection, many countries and regions in the world have introduced laws and regulations prohibiting the use of animals for cosmetic testing. For example,

the European Union, Norway, New Zealand, Israel, and India have completely banned animal testing of cosmetics, and recently banned the sale of cosmetics that have been tested on animals.

Some European countries have even introduced a ban on the use of animals for testing. Cosmetics in China have also gradually removed the requirement for mandatory animal testing.

In summary, technology, policy, market factors together to promote the prosperity of the industry today.

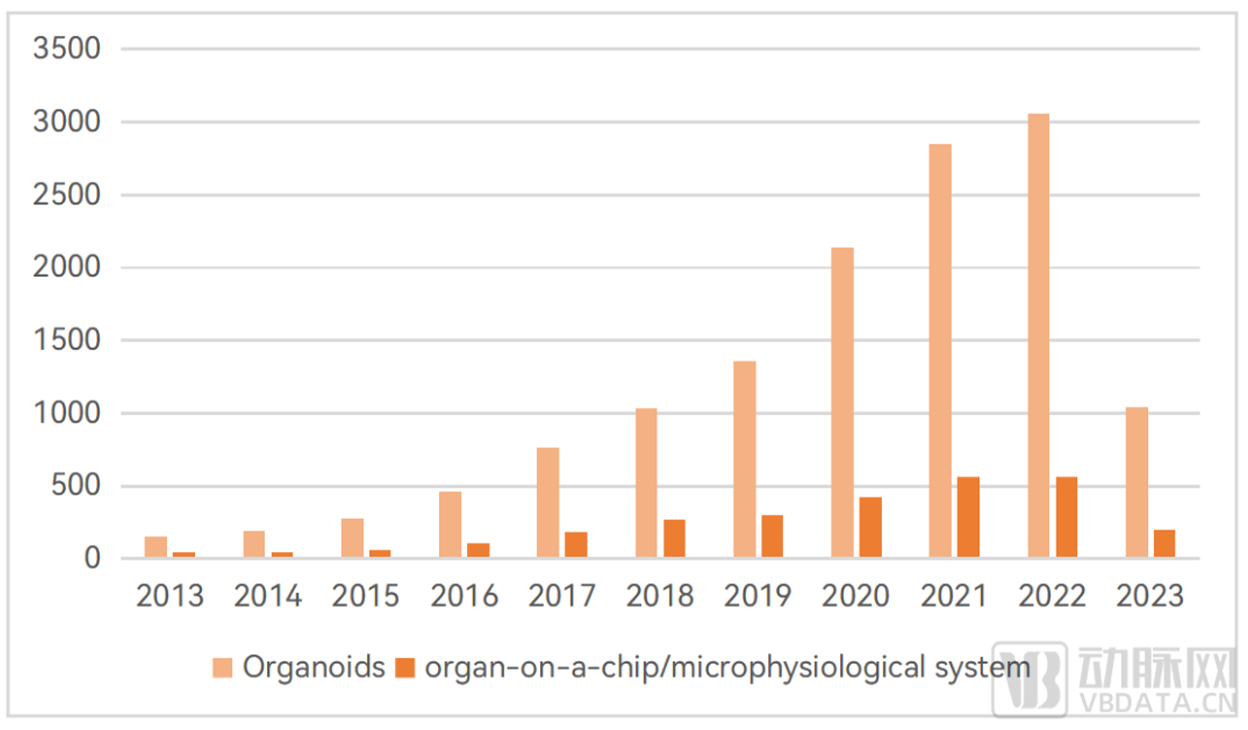

In terms of scientific research, the number of scientific research literatures related to organoids and organ chips has increased rapidly.

▼ The number of global organoids and organ-on-a-chip scientific research literature published in the past 10 years

Data source: PubMed database, Eggshell Research Institute Cartography

According to PubMed database, the related research involving organoids and organ-on-a-chip technology has been on the rise in the past 10 years, and there are many top journal literatures

such as CNS. The accumulation of research in basic science research is further accelerating the industrial process of organoids and organ chips.

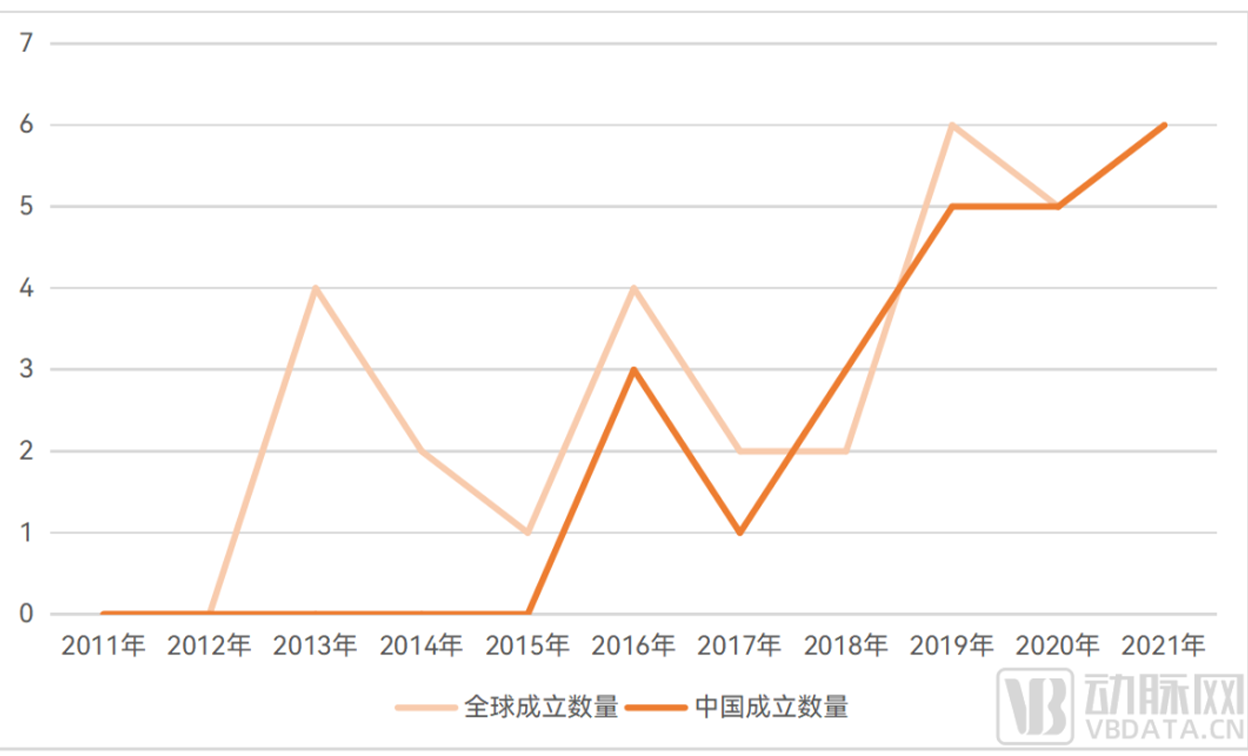

In terms of industry, a number of innovative enterprises have been established, and a number of enterprises have entered the organoid and organ chip circuit through innovative layout.

According to incomplete statistics of Eggshell Research Institute, there are currently more than 49 companies in the world specializing in the layout of organoids and organ chip tracks.

The establishment of global enterprises in the field of organoids and organ chips from 2011 to 2021

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

Dispelling the concept of organoids and organ chips

Before we begin to analyze the current development of global organoids and organ-on-a-chip, perhaps we need to clarify the concept of organoids and organ-on-a-chip.

Since organoids and organ-on-a-chip are still in the early stage of development, the definition and understanding of organoids and organ-on-a-chip in China have been ambiguous. However,

the clarification and standardization of relevant concepts are undoubtedly important for the orderly competition and healthy development of the industry.

On the basis of previous interviews with arterial New Medicine, Eggshell Research Institute conducted research with more professionals in the industry and came to the following conclusion:

Organoids and organ chips belong to different segments, but the application scenarios are similar.

▼ Organoids, organ-on-a-chip and organ-on-a-chip relationship

▲ Data source: Research interviews, Eggshell Research Institute mapping

Specifically, organoids tend to be biological and belong to the field related to stem cells. The dry cells in organoids will differentiate into different types of cells during the culture process, and

the differentiated cells are highly similar to human organs in spatial arrangement and physiological function, but they are limited in controllability and repeatability, and their complexity is

limited by the ability of cell differentiation.

On the other hand, organ chips tend to be biomedical engineering and have advantages in controllability and standardization of modeling through the introduction of microfluidic and other

technologies. More complex models can be constructed through co-culture technology, but it is often difficult to meet the requirements of throughput, cost and complexity.

Although organoids and organ chips belong to different tracks, the phenomenon that organoids and organ chips are often mentioned together or even confused in China at present is that

both belong to alternative frontier technologies and have certain combination points in application scenarios, and their application purposes are to build bionic physiological models in vitro

to better carry out disease and pharmacological research.

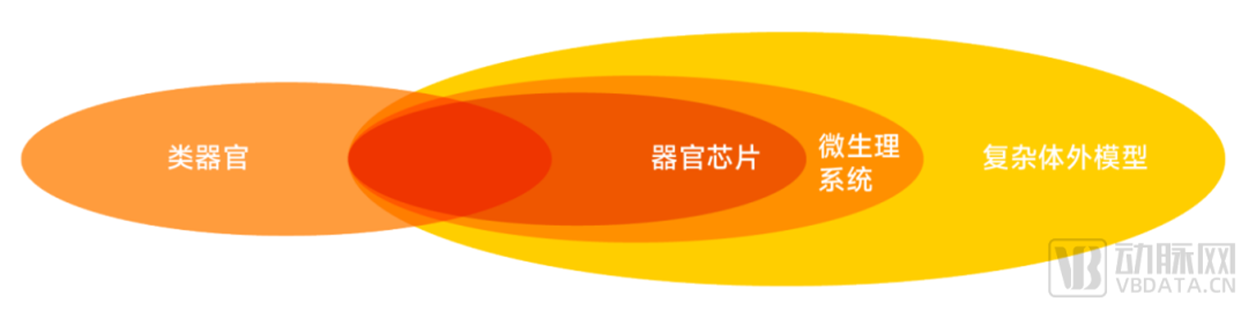

Organ-on-a-chip and microphysiological system (MPS), as subsets of the complex in vitro model (CIVM), are often referred to approximatively in the literature.

But several industry experts agree that the scope of microphysiological systems is larger than organ chips. The white paper has a clear and detailed explanation of the relevant definitions of

various in vitro models, and will not be expanded here due to space limitations.

Relationships between organoids, organ-on-a-chip, microphysiological systems, and complex in vitro models

▲ Data source: Research interviews, Eggshell Research Institute mapping

Analysis of global development status of organoids and organ chip industry

■ Analysis of the whole industry chain: middle and downstream demand has not yet been scaled up, 80% of enterprises are also upstream

At present, the upstream of the global organoid and organ chip industry chain mainly includes instrument and equipment R & D and production enterprises, reagent consumables R & D and

production enterprises, providing the industry with organoids and organ chip automated high-throughput operation instruments, chip manufacturing, imaging equipment and other

instruments and equipment, including culture plates. Reagent consumables including kits, hydrogels, nanofibers, matrix adhesives, synthetic scaffolders, proteins and special consumables,

microfluidic chips and substrates.

Midstream is an enterprise that provides organoids, organ chips and supporting technical services. Downstream mainly includes pharmaceutical and biotechnology enterprises

(pharmaceutical companies), CRO, universities and other scientific research institutes, cosmetics industry enterprises, hospitals, patients, etc.

▼ Organoids and organ-chip whole industry chain map

▲ Data source: official websites of various enterprises and research institutes, Eggshell Research Institute mapping

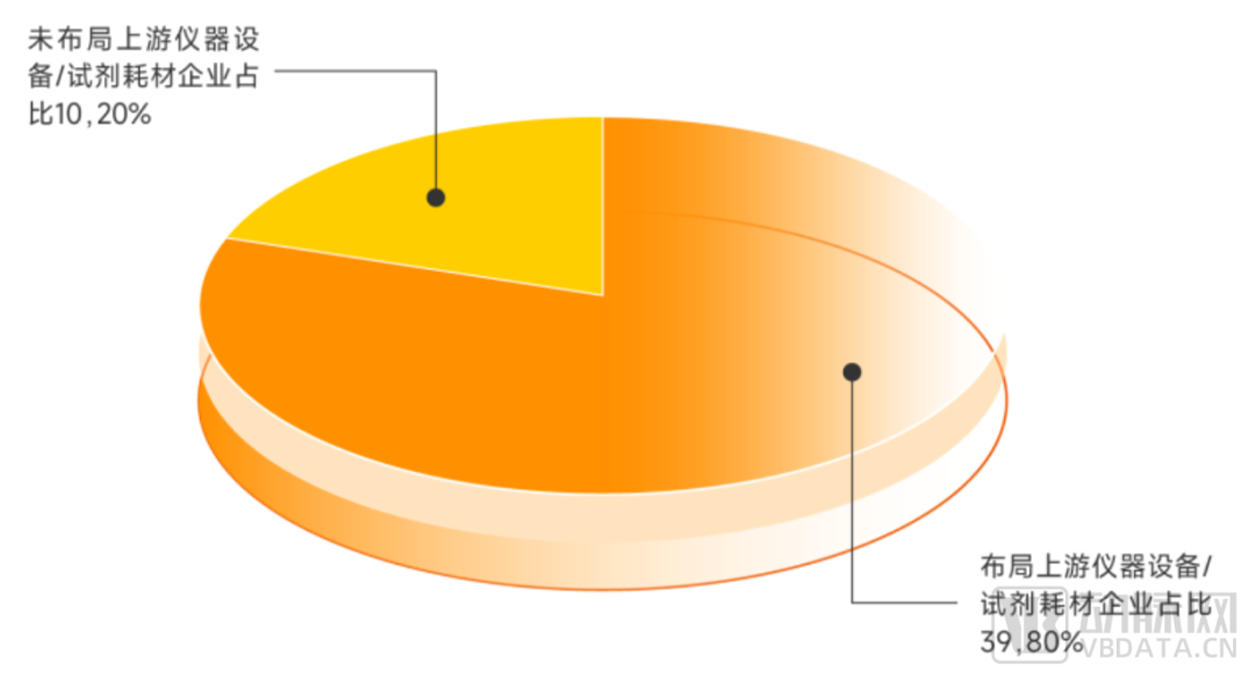

It is worth noting that because the current organoid and organ chip industry is still in the early stage of development, the middle and downstream demand has not yet been expanded, so

many enterprises in organoids and organ chips have played a part of the upstream role to some extent, and more of their own research and development of organoids and organ chip

automation, high-throughput operating instruments and imaging equipment. According to incomplete statistics of Eggshell Research Institute, the proportion of global organoids and organ

chip enterprises in the layout of upstream instruments and equipment or reagent consumables is as high as 80%.

▼ The upstream layout of global organoids and organ chip enterprises

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

With the further development of the industry, the total demand for upstream instruments and equipment/reagent consumables in the middle and downstream demand has further increased,

and enterprises specializing in creating related instruments and equipment as well as R & D and production of reagent consumables have begun to appear.

With the further development of the industry in the future and the landing of relevant policies and standards, the industry's demand for upstream will promote the birth of more professional

upstream enterprises and the business transformation of some organoids and organ chip enterprises, and the enterprises that take the lead in the in-depth layout of the upstream will

undoubtedly have a first-mover advantage.

■ Analysis of industry status: overseas development progress is faster than domestic and shows obvious differences in development

Because foreign policies and financial support are more in place and research is carried out earlier, the overall development progress of foreign organoids and organ chips industry is faster

than that of domestic.

From the perspective of the industrial application of organoids, some foreign organoid enterprises have solved the compliance and ethical issues of the cultivation and use of organoids. For

example, the HUB, an organoid technology incubation enterprise co-founded by Hans Clevers, has built an organoid model library with a certain number and variety richness, so that some

of the organoids can be called at any time for purposefully expanded and frozen storage, so as to carry out targeted scientific research, or serve downstream customers such as

pharmaceutical companies.

Overseas organoid companies such as InSphero, OcellO (which has been acquired by CrownBio) and Cellesce have solved some problems in high throughput, repeatability and non-standard

manual culture of organoids, and successfully applied them in the field of drug research and development, and the main customer groups are pharmaceutical companies and scientific

research institutes.

The domestic organoid industry is developing rapidly, but its ability in organoid culture quality control and sample compliance needs to be further improved. For example, the work in

addressing the compliance and ethics of organoid samples is not enough, and some models in the organoid bank have not reached the applicable standards and lack relevant quality control

standards.

In the field of organ chips, the global core manufacturers of organ chips are mainly distributed in North America and Europe, including Emulate, TissUse, Hesperos, CN Bio and other head

organ chip companies occupy more than 50% of the global market share, foreign organ chip companies are currently in a dominant position, China's industrialization process is relatively

backward.

The reason is that organ chip is a highly interdisciplinary frontier technology, and the technical threshold is high. In addition, due to the different focus of solving problems in countries at

different stages of development, compared with Europe and the United States, China's organ chip industry lacks funding and systematic support from the government in the country as a

whole.

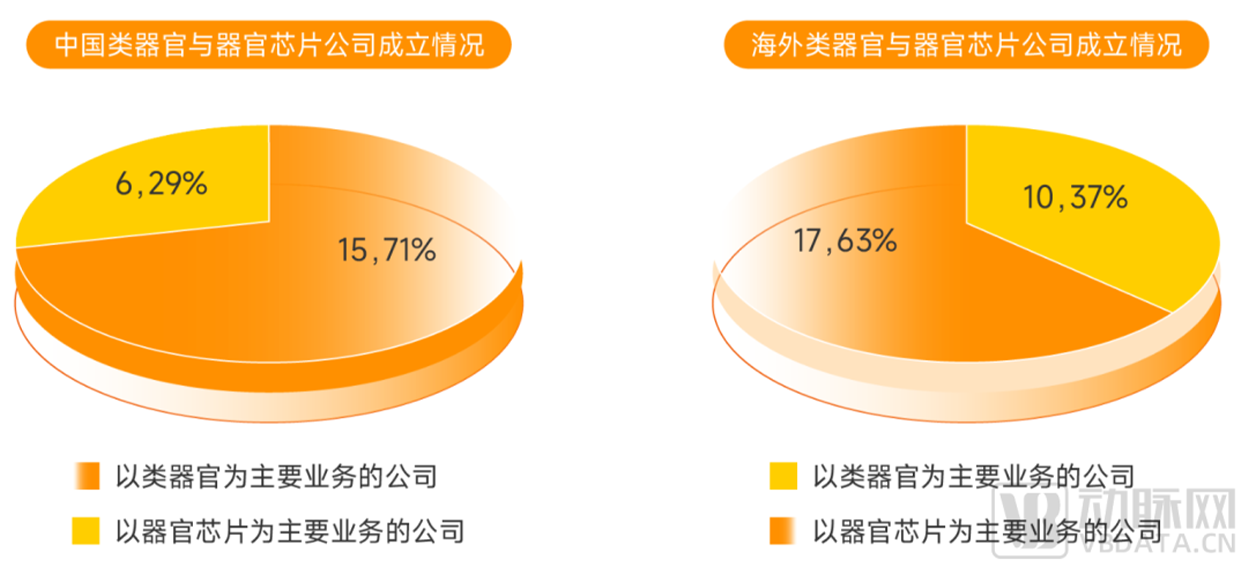

The domestic industrial development of organoids is more prosperous, the number of foreign industrial organ chip enterprises accounts for a larger proportion, and the focus of the

development of organoids and organ chips at home and abroad is almost the opposite.

According to incomplete statistics of Eggshell Research Institute, at present, enterprises in China with the development of organoids as their main business account for 71% of the total

number of enterprises in the field of domestic organoids and organ chips, and overseas enterprises with the development of organ chips as their main business account for 63% of the total

number of overseas enterprises in the field of organoids and organ chips.

▼ The difference in the establishment of organoids and organ chip enterprises at home and abroad

▲ Data source: Arterial Orange database, Eggshell Research Institute mapping

We believe that there are two main reasons for this phenomenon: one is the different foundation of technology accumulation, and the other is the difference in market demand development

caused by different national conditions.

First of all, look at the field of organoids, the reasons behind the "domestic industrial development of organoids is more prominent", including some technical problems and obstacles already

mentioned above, as well as the imperfect guidance policy for domestic regulatory approval. In addition, due to different national conditions, the application of organoids to the clinical end

of the development of cancer precision medicine layout drug sensitivity screening is the domestic market demand that is different from overseas.

As a cancer country, China has a large number of both total cancer patients and new cancer patients, and the 5-year survival rate of cancer patients is significantly lower than that of overseas

developed countries. In addition to the treatment itself, a very important factor affecting the five-year survival rate of patients is early screening and early diagnosis.

Chinese people's awareness of early screening of tumors is weak, and most patients are often diagnosed and treated when they are sick and the symptoms are very obvious. Since a large

number of cancer patients are asymptomatic in the early stage of the disease, and the diagnosis stage is more concentrated in the middle and late stage of the disease, most Chinese cancer

patients may have developed to the middle and late stage once diagnosed. At this time, if the drug administration program suitable for patients can be found as soon as possible, it will

undoubtedly be of great help to patients. China has a large population of cancer patients and a rising trend of development, so that tumor organoids have great application prospects in the

field of drug sensitivity detection.

Advantages of Xilis enterprise MOS platform

The number of foreign industrial organ chip companies accounts for a larger proportion, and we guess the main reasons include two aspects.

On the first hand, foreign countries are more advanced in drug research and development, and the market demand for organ chips is more urgent.

As mentioned in the previous report, the research and development direction of pharmaceutical companies is changing, from small molecules to large molecules, from chemical drugs to

antibody drugs, Protac, peptides, small nucleic acid drugs, gene cell therapy, etc., and the traditional biological model can no longer meet the research and development needs of

pharmaceutical companies.

In addition, Dr. Yin Xiushan, founder of Kunshi Biology, pointed out that in the conduct of animal experiments, foreign countries face greater ethical pressure and time costs than domestic

animal experiments.

For example, related animal experiments involving gene editing need to use primates, but according to the current European policy environment and animal resources, gene editing related

animal experiments may take more than four years to wait in line, and will face greater resistance in ethical procedures. In contrast, in China, if the financial resources are in place, the relevant

experiments can be directly started in 3 months.

At present, the amount of animal testing done by many European research institutes has fallen sharply. Some companies, such as T-knife Therapeutics, have moved their animal testing

deployments entirely to the United States.

The second aspect is that the organ chip industry started earlier in the United States, and government departments have greater support for organ chip related research.

At present, the overall technology of organ chips in China is still in the early stage of development, and there are fewer teams to master the core technology of organ chips, most of which are

still doing some relatively simple or individual types of organ chips, and there is still a lot of room for growth.

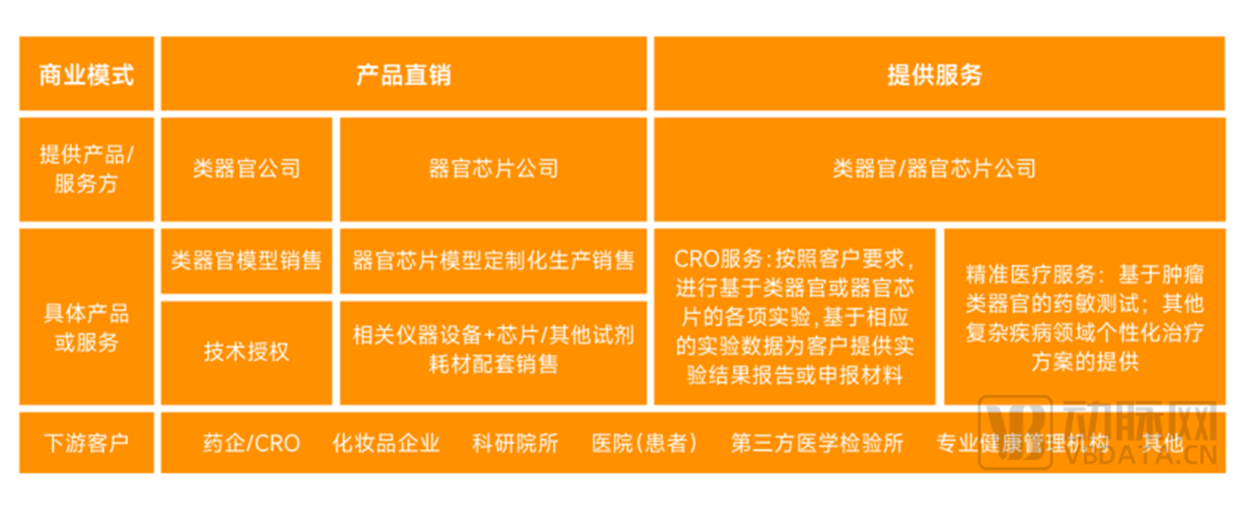

Current status of commercialization exploration: Mainly product direct selling and service provision, the future development path can be partially referred to CRO

According to the research and interview of Eggshell Research Institute, the global organoid and organ chip industry currently has two main business models: product direct sales and service

provision. Specific to the organoid and organ chip industry performance is slightly different.

The main business model of organoids and organ chip enterprises

Source: Survey interviews, Eggshell Institute cartography

Product direct selling generally means that organoids or organ chip companies directly provide organoids or organ chip models to customers in the form of standardized products, and there

are various sales forms according to different requirements of different customers.

For organoids, the most mainstream form of product direct sales is standard organoid model sales, in which organoid companies provide specific types of organoids to customers

(mainly B-side customers such as pharmaceutical companies /CRO/ cosmetics companies and scientific research institutes) to meet customers' R & D requirements.

However, Dr. Lu Zhenghao, director of research and development of bio-organoids, pointed out that "at present, this model still needs to be explored, especially patient-derived organoids, in

addition to considering regulatory policy factors, we actually pay more attention to the application value of additional organoids." Therefore, organoid enterprises provide customers with the

research value of specific kinds of organoids in the form of technical services."

Another profit model of the organoid industry is that enterprises can obtain IP licensing fees by authorizing technologies to other countries in the form of technology authorization. For

example, HUB has promoted the establishment and development of Epistem, Cellesce, Crown Biosciences and other enterprises through technology authorization.

In the field of organ chips, the most mainstream form of direct product sales is customized production and sales, that is, organ chip enterprises carry out customized organ chip design and

production according to customer requirements, and provide corresponding equipment to customers. Another profit model is that the enterprise conducts supporting sales in the form of

organ chip related instruments and equipment + chips and other reagents and consumables: the enterprise will sell, lease or gift the relevant equipment required for operation to customers

in various forms, and sell the chip including other reagents and consumables to customers.

Service mode generally refers to the organoids or organ chip enterprises rely on their own organoids or organ chip models to provide corresponding supporting services directly according to

customer needs, mainly including two types of service.

Among them, CRO service refers to the organoid or organ chip enterprises in accordance with customer requirements, based on the organoid or organ chip experiments, and then based on

the corresponding experimental data to provide customers with experimental results report or declaration materials. Precision medical services mainly refer to drug susceptibility testing

based on tumor organoids, providing personalized drug regimens for cancer patients in need.

It is worth noting that the channels of precision medical services are slightly different from the above profit models, and the main carrier of services is mainly through hospitals, third-party

medical laboratories or professional health management institutions, so you can see the layout of many organics companies to set up third-party medical laboratories, such as Jingke biology,

Ketao medicine, Chuangxin International, Danwang Medical.

At present, the global focus on organoids and organ chip business has not yet listed a company. The fastest growing is Emulate, an organ-chip company that has raised a Series E round

of funding. Many companies in the industry, such as Epistem, OcellO, TARA Biosystems, etc., are currently in the form of acquisitions to achieve the next stage of development. So, what are

the possible development paths of organoids and organ chip industry enterprises in the future?

There are three possible development paths for the industry in the future: precision instrument and equipment enterprises, CRO and Biotech

▲ Data source: Research interviews, Eggshell Research Institute mapping

For the future development path of organoids and organ chip companies, some industry insiders believe that companies such as Emulate may gradually develop into precision instrument and

equipment companies (equipment and reagents are its core) in the future, which can be seen from its business layout.

Following a review of Emulate's product line, various types of organ chips are currently under development. "Emulate has grown in popularity with its organ-on-chip models in order to sell its

devices," industry sources say. In addition, this is partly reflected in his personnel appointments in the past two years.

Another part of the industry believes that in essence, organoids and organ chips are a technology platform, mainly to serve a certain link in the new drug research and development process,

and the mainstream direction of future development should be CRO. For example, some investors believe that the organoid track belongs to the large scope of the field of life science tools,

and the general development logic of the future industry is similar to that of the CRO industry, which has a role and logic of gold mining and water selling people.

In addition, from the Eggshell research Institute's research interviews with a number of industry veterans, we also learned that another business model may be widely appeared in the future,

that is, Biotech companies based on organoids or organ chips for new drug development. The new drug pipeline is developed by a team with drug development capability based on its own

advantages in organoid or organ-on-a-chip model construction. The future development path can refer to the development model of "AI Biotech" type enterprises in the field of AI+ new

drugs.

Yin Xiushan, founder of Kunshi Biology, believes that for human diseases, from the perspective of prevention, diagnosis and treatment, organoids and organ chips should be from the

diagnosis and treatment to meet human needs. In terms of diagnosis, organoids and organ chips, as a detection platform at the cell level, can be combined with nucleic acid level sequencing,

protein level mass spectrometry and other detection and secretion markers for complementary evaluation, so as to find a more accurate treatment plan for patients. At the same time, in

terms of treatment, organoids and organ chips will slowly change from the auxiliary links of drug research and development to the foreground with the maturity of technology, and eventually

become organ drugs, completing the transition from cell drugs to organ drugs. This process is roughly divided into pure organ drugs and artificial organ drugs assisted by electronic

engineering chips.

At present, the main application scenario analysis

At present, the main application scenarios of the organoid and organ chip industry include disease modeling, toxicity testing, high-throughput drug screening, drug evaluation,

drug indication expansion, cancer precision therapy, regenerative medicine, aerospace medicine, etc.

▼ Organoids and organ chips are currently the main application scenarios

▲ Data source: Research interviews, Eggshell Research Institute mapping

Among them, cancer precision treatment is the hottest market for the application of domestic organoid technology. Some practitioners estimate to the arterial network that the collection of

samples for domestic organoid precision medicine has exceeded 10,000 cases each year. Including South Hospital, Changhai Hospital, West China Hospital, Fudan University Affiliated Cancer

Hospital and other hospitals have carried out corresponding clinical studies.

At present, organoid technology has covered more than 20 types of organs, including lung cancer, breast cancer, bile duct cancer, stomach cancer, colorectal cancer, etc. The success rate of

some tumor organs in vitro culture is as high as 95%. By combining with second-generation sequencing, it can further improve the precision treatment effect of cancer patients. At present,

organoids are mainly used for sensitivity detection of chemotherapy drugs, and with technological progress, they also have great potential for targeted drugs and immunotherapy in the

future.

Although the current market for organoids for drug susceptibility testing is very hot, there are also some development limitations that need to be looked at objectively.

On the one hand, it is difficult to scale the application of products due to the high heterogeneity of tumors. In organoid precision medicine experiments, each time it is necessary to do

personalized design based on the patient and sample situation, and different tumor species, different parts of the sample, and different cell types in the sample correspond to different

culture methods and formulas. This may cause it to be difficult to achieve the commercialization of organoid precision medicine in the short term, and the market size will be slow to increase.

In addition, some companies pointed out that "even if the iteration of technology and industrialization is completed, the proportion of tumor patients who have real demand and have the

opportunity to benefit from organoid precision medicine is relatively limited in the stock and incremental population."

In addition, the heterogeneity of tumors is also reflected in spatial heterogeneity. "Whether tumor tissue used to culture organoids can contain all lesions will directly affect the accuracy of

drug screening." At present, organoids still need to solve the key problem of how to more accurately reflect clinical heterogeneity and the impact of tumor microenvironment on drugs, in

order to truly realize the significance of accurately guiding patients to use drugs." Dr. Song Guangqi, the founder of Puheng Technology, previously worked in Zhongshan Hospital Affiliated to

Fudan University and knows the pain points of products in clinical application.

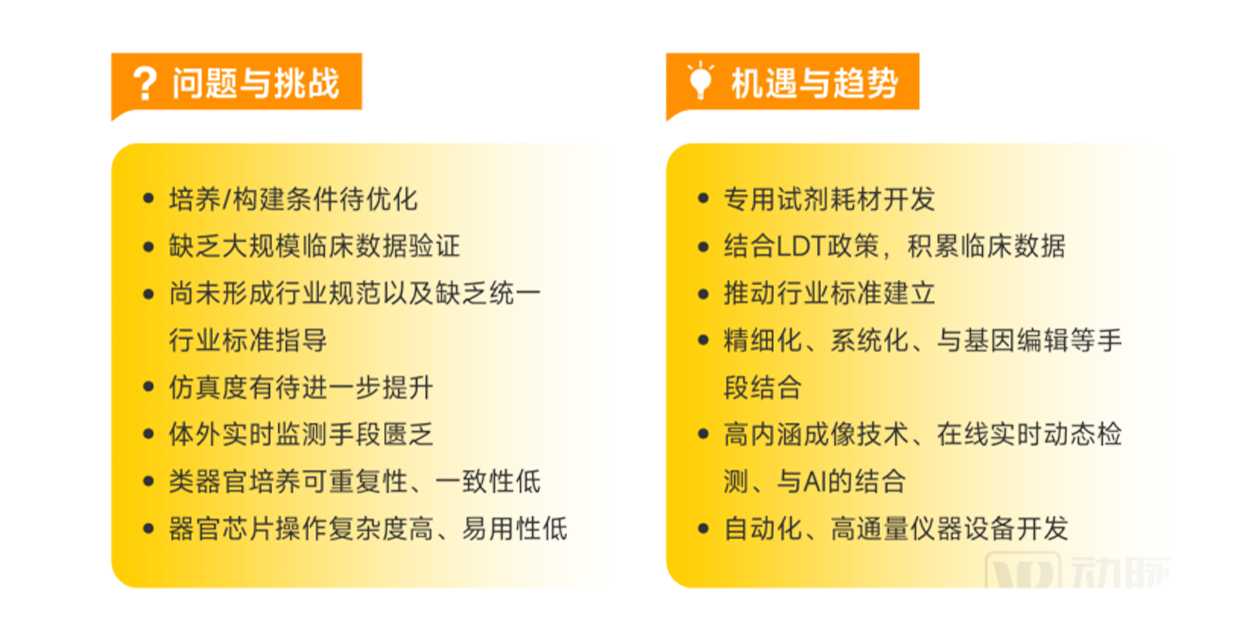

Existing challenges, opportunities and industry trends in organoid and organ chip industry

▲ Data source: Research interviews, Eggshell Research Institute mapping

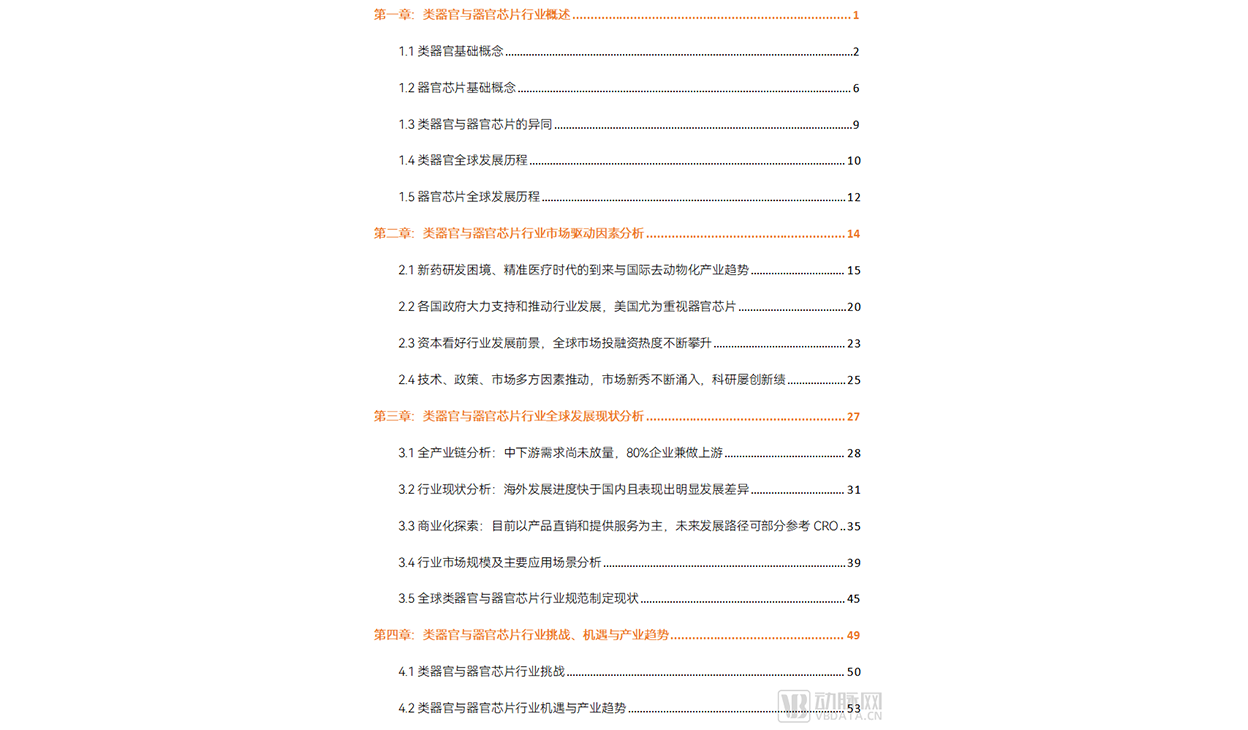

The above are the main excerpts of the report, and the complete framework of the report is as follows:

As a global leader in macrophage drugs, Kunshi Biology has conducted a strategic cooperation with Pu Heng Technology to evaluate the efficacy of CAR-M in organoid systems. Based on the unique NAC-Organ in vitro model technology of Puheng Technology, the CAR-M 3D screening platform for Solid Tumor cell therapy (NAC-Solid tumor) was jointly developed to efficiently evaluate the tumor targeting, invasion and killing ability of CAR-M cells. As the first company in the world to use 3D organoids for macrophage cell drug development, Kunshi Biology will continue to maintain an open attitude to new technologies and the spirit of exploration of new methods.

0512-67998889(Suzhou)

18051093220(Shenzhen)

Cathy.Lv@rocrockbio.com(Suzhou)

lliangjing@rocrockbio.com (Shenzhen)